Search This Blog

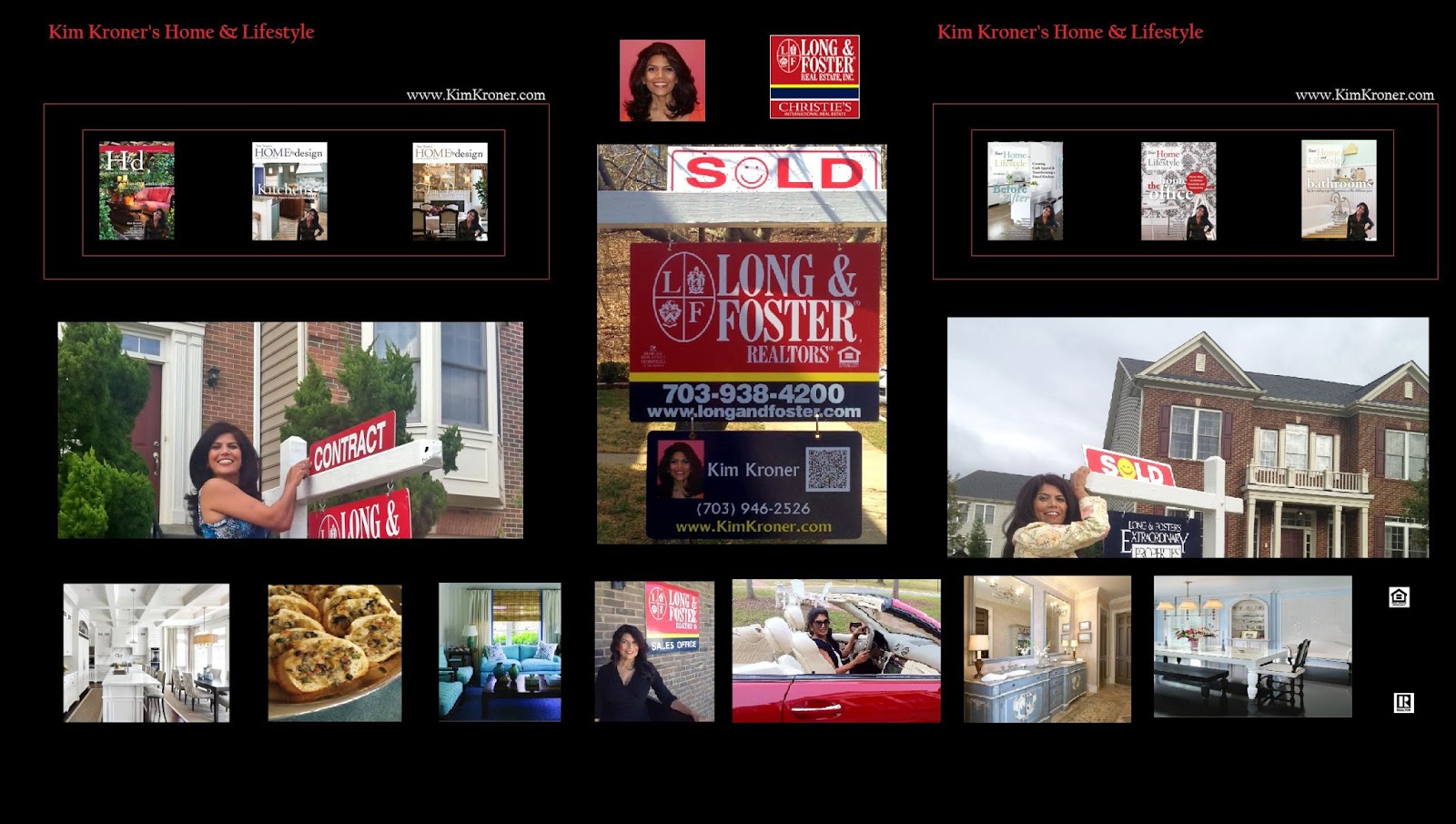

Kim Kroner’s Home & Lifestyle, Kim Kroner is Northern Virginia Association of Realtor's Multi Million Dollars Club Top Producer and top-producing Realtor, Real Estate Associate Broker. Coldwell Banker Luxury division Extraordinary Properties, Christie's International Real Estate and Luxury Portfolio International. Realtor in Northern Virginia and Maryland.

- Get link

- Other Apps

Popular Posts

Buying or Selling in Virginia or Maryland?

- Get link

- Other Apps

Comments

Post a Comment